Life Insurance Strategies

Life insurance offers financial protection during your working years, ensuring your family's well-being by paying off debt and replacing lost income if you pass away prematurely. The benefits can ease debt, support education, and maintain your family's lifestyle, even in your absence.

Beyond this, life insurance is a versatile retirement, estate, and legacy planning tool. Its unique features include:

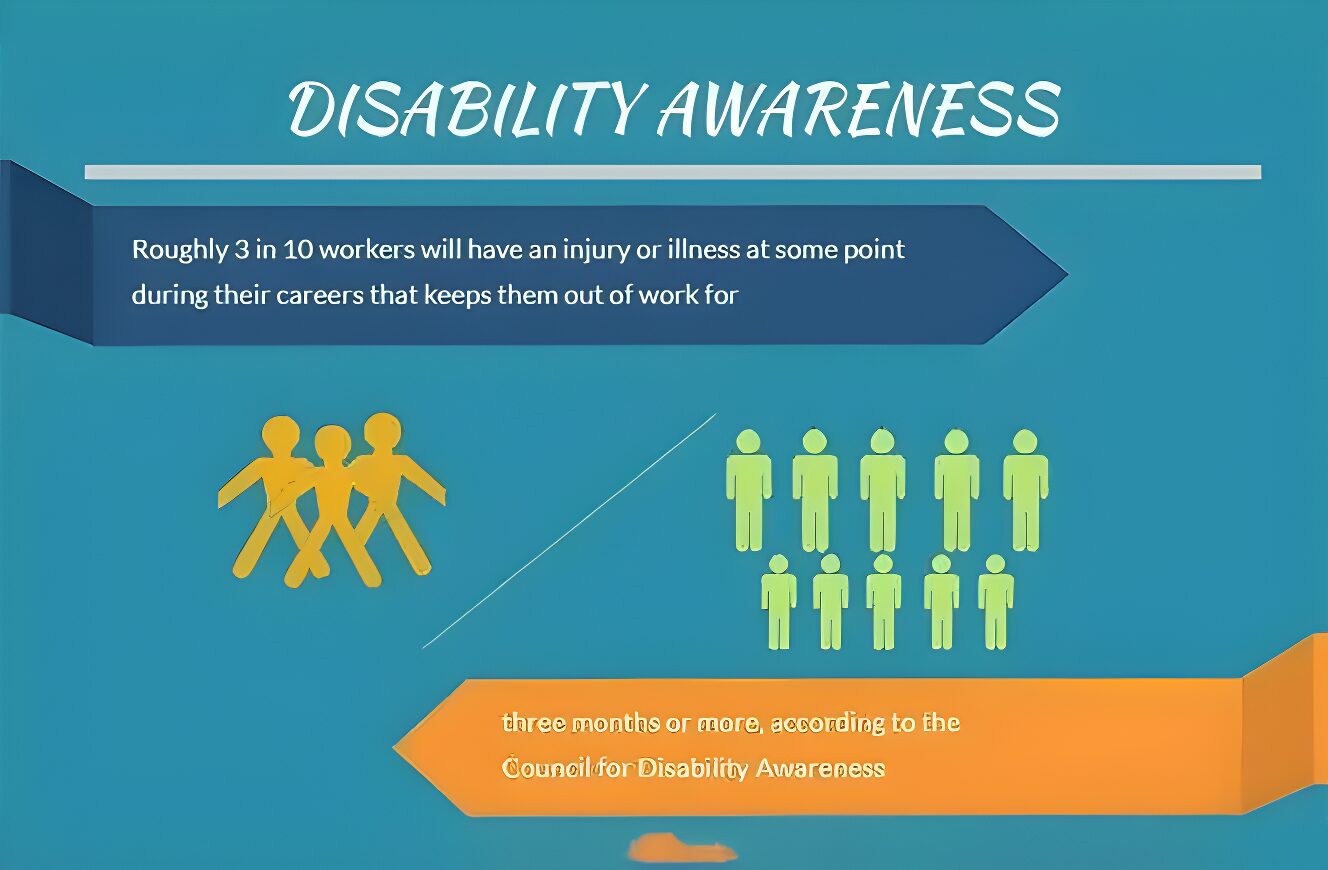

Disability Insurance

Many prioritize savings, investments, or real estate, yet often overlook their most crucial asset—their ability to work and earn income. Your income supports your living expenses, lifestyle, and financial commitments.

Consider:

Remember, without income, traditional assets like your home can't be leveraged. Secure your income just as you protect your cars, home, and health with insurance.

Key Person Protection

In every organization, certain individuals are irreplaceable. Key person insurance safeguards against financial strains caused by losing a pivotal contributor, such as a director, partner, or skilled professional. Secure your business's future with proactive planning and key person protection. You can contact us for more information.